INVESTING IN A BETTER FUTURE

Ocean Wilsons (Investments) Limited is our Bermuda based subsidiary that holds our portfolio of international investments. Privately managed by our Investment Manager, Hanseatic Asset Management LBG, the investment strategy for our portfolio is to generate real returns through long-term capital growth, whilst emphasising preservation of capital without respect to short-term moves in equity markets.

Investment Strategy

The Board has established an investment strategy with the Investment Manager that invests in publicly quoted and private (unquoted) assets across three ‘silos’: (i) Core regional funds, (ii) Sector specific private equity, and (iii) Diversifying.

(i) Core regional funds

This forms the core of the portfolio and provides global exposure mostly through single-country and regional equity funds. By managing the weights of these we can reflect the Investment Manager’s current market view. Thematic funds are also included to provide exposure to growth sectors such as technology and biotechnology, where we feel specialist management is often beneficial.

(ii) Sector specific private equity

We take advantage of the portfolio’s long-term investment horizon by investing in private equity funds in sectors with long-term growth attributes, such as technology and biotechnology/healthcare. This provides access to the illiquidity premium afforded by being able to commit capital for multiple years and also to large areas of the economy that are not accessible through public markets.

(iii) Diversifying

As business cycles mature, we seek to shift dynamically to those asset classes that are likely to add portfolio protection. This component includes a wide variety of investment strategies, with the common thread that they all display low correlations to broad equity markets.

The Investment Manager maintains a global network to find the best opportunities across the three silos worldwide. The portfolio contains a high level of investments which would not normally be readily accessible to investors without similar resources. Furthermore, a large number of holdings are closed to new investors.

Commensurate with the long-term horizon, it is expected that the majority of investments will be concentrated in equity, across both ‘public’ and ‘private’ markets. In most cases, investments will be made either through collective funds or limited partnership vehicles, working alongside expert managers in specialised sectors or markets to access the best opportunities.

All investments are reviewed on a regular basis to monitor the ongoing compatibility with the portfolio, together with any ‘red flags’ such as signs of ‘style drift’, personnel changes or lack of focus. Whilst the Investment Manager is looking to cultivate long-term partnerships, every potential repeat investment with an existing manager is assessed as if it were a new relationship.

Portfolio Characteristics

The portfolio has several similarities to the ‘endowment model’. These similarities include an emphasis on generating real returns, a perpetual time horizon and broad diversification, whilst avoiding asset classes with low expected returns (such as government bonds in the current environment). This diversification is designed to make the portfolio less vulnerable to permanent loss of capital through inflation, adverse interest rate fluctuations and currency devaluation and to take advantage of market and business cycles.

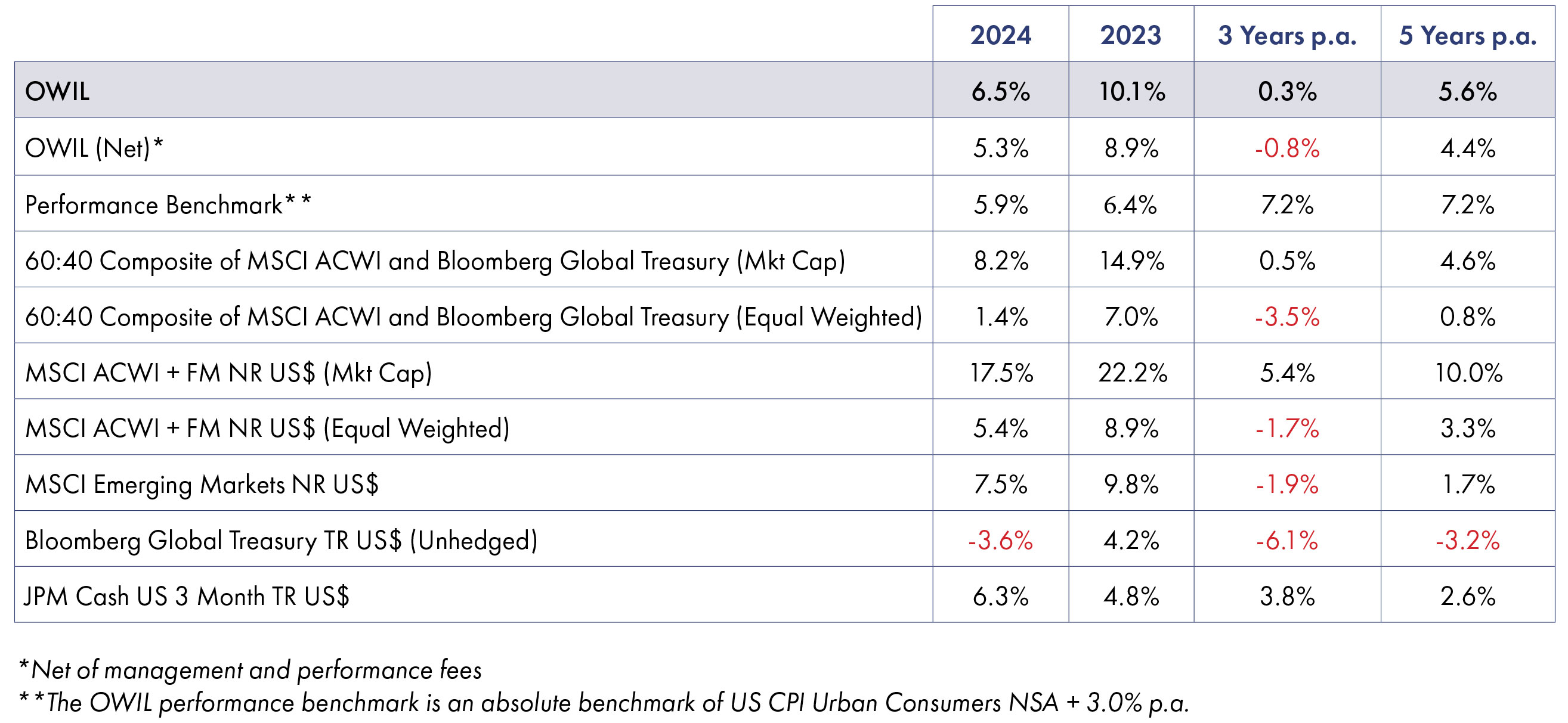

Cumulative Portfolio Returns

Investment Management Fee

The Investment Manager receives an investment management fee of 1% of the valuation of funds under management and an annual performance fee of 10% of the net investment return which exceeds the benchmark, provided that the high-water mark has been exceeded. The portfolio performance is measured against a benchmark calculated by reference to US CPI plus 3% per annum over rolling three-year periods. Payment of performance fees are subject to a high-water mark and are capped at a maximum of 2% of portfolio NAV.